Non-energy growth sustained in March

Doha, Qatar: 3 April 2024 – Qatar's non-energy private sector recorded a further improvement in business conditions in March, according to the latest Purchasing Managers’ Index™ (PMI®) survey data from Qatar Financial Centre (QFC) compiled by S&P Global. Output, new orders, employment and purchasing activity all increased since February. Companies completed volumes of outstanding work at the fastest rate in six months, and the 12-month outlook remained positive. Cost pressures remained stable, with average input costs broadly unchanged since February. Meanwhile, charges rose at the strongest rate since February 2023.

The Qatar PMI indices are compiled from survey responses from a panel of around 450 private sector companies. The panel covers the manufacturing, construction, wholesale, retail, and services sectors, and reflects the structure of the non-energy economy according to official national accounts data.

The headline Qatar Financial Centre PMI is a composite single-figure indicator of non-energy private sector performance. It is derived from indicators for new orders, output, employment, suppliers’ delivery times and stocks of purchases.

The PMI registered 50.6 in March, down slightly from 51.0 in February. The latest figure remained above the no-change mark of 50.0 and thereby signalled a sustained improvement in business conditions in the non-energy private sector economy.

The three largest components of the PMI – output, new orders and employment – all registered above 50.0 index readings in March, indicative of month-on-month expansions. As has been the case for the past four months, shorter suppliers' delivery times and a reduction in input stocks both weighed slightly on the headline figure.

Demand for goods and services in Qatar's non-energy economy continued to expand in March. Firms linked growth to new customers, competitiveness and high-quality products. The rate of growth eased slightly, enabling a faster reduction in the volume of outstanding business.

Total activity increased further in March. Growth over the first quarter as a whole was broadly comparable to that registered in the fourth quarter of 2023.

Looking ahead towards the next 12 months, companies were optimistic on growth in March. Overall sentiment was linked to new clients, development strategies and efforts to raise profitability.

Qatari firms continued to expand their workforces, extending the current sequence of growth to over a year. Purchases of inputs rose for the first time in three months, albeit only slightly, as firms continued to deplete inventories. Pressure on supply chains remained limited as lead times were shortened for the twenty-third successive month.

Average input prices were broadly stable in March, with similar trends for both wages and purchase costs. Output prices rose for the first time in five months, however, and at the fastest rate since February 2023. This suggested improving profitability at Qatari non-energy private sector firms at the end of the first quarter.

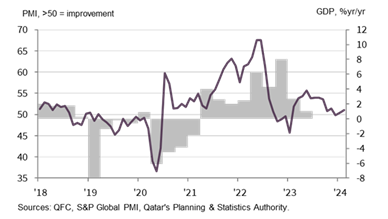

QFC Qatar PMI vs. GDP

Financial services maintain expansion

- Further growth in activity and new business in March

- 12-month outlook strengthens

- Prices charged and costs both fall

Qatari financial services companies recorded further growth in volumes of total business activity and new contracts in March. The seasonally adjusted Financial Services Business Activity and New Business Indexes posted 51.2 and 50.7 respectively. Companies were also the most optimistic regarding the 12-month outlook for activity for four months.

Meanwhile, employment at financial services firms rose for the twelfth month running, albeit at a slightly softer rate.

In terms of prices, average charges set by financial services companies fell for the third month running. Meanwhile average input prices fell for the first time in six months.

The PMI remained firmly in stable territory in March, reflecting further growth in output, new orders and employment in the Qatari non-energy economy. In the first quarter of 2024 the headline index has trended in line with the average for the fourth quarter of 2023, indicating sustained economic growth.

The latest data also signalled improving profitability. Input costs were broadly flat over the month, but charges for Qatari goods and services rose the most in over a year, pointing to higher margins.

Yousuf Mohamed Al-Jaida

Chief Executive Officer, QFC Authority

Contrast View

Contrast View

Increase Text

Increase Text

Decrease Text

Decrease Text

Reset Text

Reset Text