Non-energy growth eases at start of 2022, but remains strong

Purchasing Managers’ Index™ (PMI™) survey data from Qatar Financial Centre (QFC) continued to signal strong growth in the non-energy private sector at the start of 2022. The rates of expansion in output, new orders and backlogs of work all made further corrections from last November's records, but were still among the fastest registered throughout the near five-year history of the survey. This comes at a time of reinstated temporary restrictions related to the Omicron variant of COVID-19 throughout Qatar. Despite this overall easing, employment rose for a record sixteenth successive month. The latest survey also revealed a slight easing of inflationary pressure in the non-energy economy.

The Qatar PMI indices are compiled from survey responses from a panel of around 450 private sector companies. The panel covers the manufacturing, construction, wholesale, retail, and services sectors, and reflects the structure of the non-energy economy according to official national accounts data.

The headline Qatar Financial Centre PMI is a composite single-figure indicator of non-energy private sector performance. It is derived from indicators for new orders, output, employment, suppliers’ delivery times and stocks of purchases.

The PMI eased further from November's record high of 63.1 to 57.6 in January, from 61.4 in December. The latest figure was still the seventh-highest in the survey history. In comparison, the PMI has trended at 51.3 since it was first compiled in April 2017.

The 3.8-point drop in the PMI in January was the largest observed since September 2020. It was reflected in all five of the headline figure's components with the biggest directional influence coming from new orders (-2.2 points), followed by output (-0.9), suppliers' delivery times (-0.4), employment (-0.3) and stocks of purchases (-0.1).

Private sector non-energy output in Qatar rose for the nineteenth consecutive month in January. The rate of growth eased to a five-month low but remained among the strongest recorded to date. Growth remained notably strong in the wholesale & retail sector, while contraction was steepest in construction and services where COVID-19 restrictions had an impact.

New business inflows also increased further in January. The rate of growth eased since the end of 2021, but remained above the strong trend over the current 19-month expansionary sequence. There were notable slowdowns in the construction and services sectors, but these were partly offset by ongoing strong new business growth in manufacturing and wholesale & retail.

Demand for goods and services remained strong enough to generate rising backlogs at firms. The increase in outstanding business was softer than at the end of 2021, but still the fourth-strongest in the survey history.

Employment in the non-energy private sector continued to rise in January, extending the current series-record sequence of job creation to 16 months. The rate of growth eased since December but remained faster than the long-run trend. Recruitment remained strongest in the wholesale & retail sector.

Input price inflation was registered for the sixth month running, the longest sequence of cost increases for over three-and-a-half years. The rate of inflation eased, however, as did the pace at which output prices rose.

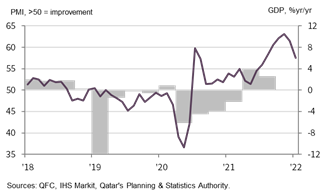

QFC Qatar PMI™ vs. GDP

Financial sector new business growth accelerates in January

- Growth rate for new business picks up since December

- Sustained increase in employment at financial firms

- Input costs for financial services firms continue to rise solidly

The latest PMI data on Qatar's financial services sector signalled strengthening demand in January. New business received in the sector rose at a faster pace than in December, and one of the strongest since the series began in 2017. Total activity growth eased but was still the fifth-strongest on record.

Employment at financial services firms rose for the fifth month running, the longest sequence of job creation in over two years, despite a moderation in business expectations at the surveyed firms.

Average input costs at financial services firms rose solidly for the fifth month running in January, and at a rate sharper than the long-run series trend. Meanwhile, prices charged for financials services rose slightly, having been discounted in December.

Comment

"Although the PMI posted a further correction from November's all-time high at the start of 2022, easing to 57.6, it is holding at one of the highest levels seen since the survey began in April 2017. Prior to last August and excluding the post-lockdown bounce to 59.8 in July 2020, the highest the PMI had ever reached was 56.3 in October 2017.

"The first batch of data for 2022 therefore signals that the non-energy economy continues to expand sharply, with the key indicators for output, new orders and employment all remaining well above their long-run averages. The forthcoming FIFA World Cup continues to be cited as a source of confidence among companies.

"Recent PMI data for the final quarter of 2021 signal that official economic growth will regain momentum, having eased to 2.6% on an annual basis in the third quarter from 4% in the third quarter."

Yousuf Mohamed Al-Jaida

Chief Executive Officer, QFC Authority:

Contrast View

Contrast View

Increase Text

Increase Text

Decrease Text

Decrease Text

Reset Text

Reset Text